GoCardless allows you to charge clients by direct debit who authorise you to do so.

1) Head to

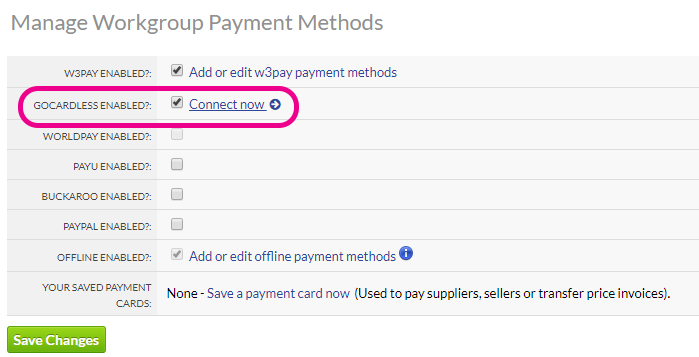

Tick "GoCardless Enabled"

Then press the Connect now link

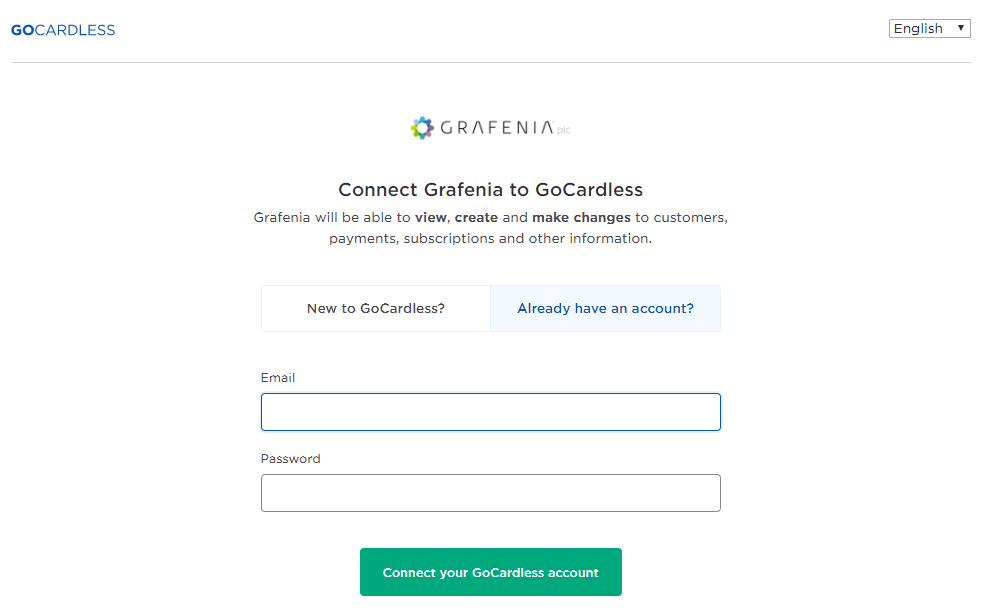

2) Connect your existing GoCardless account

Or sign up to a new account

Press connect and that's done.

3) Complete your GoCardless account set up, you will need to connect your bank account and make a few penny transaction to GoCardless to verify that you can access the account

Clients need to authorise you to collect by Direct Debit before you can charge them through GoCardless.

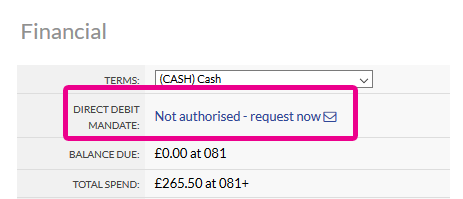

Once you've signed up to GoCardless - you'll be able to request authorisation

1) Head to

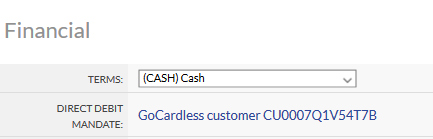

In the Financial section, you'll see a link

Click this to open up an email template

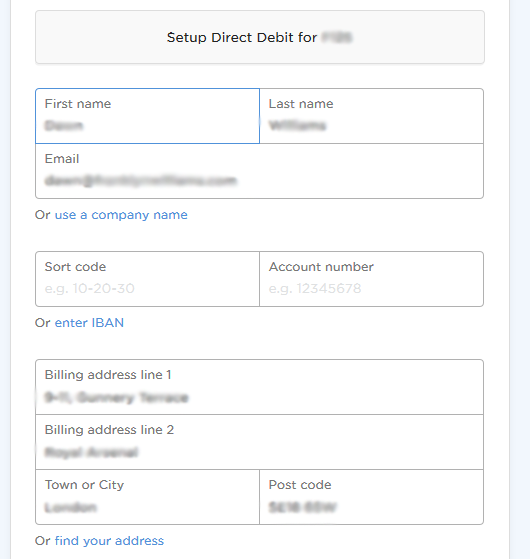

2) The email has a link clients use to sign up to Direct Debit

3) When this is filled in the client will show as authorised in Flyerink and we'll add a link to their customer in GoCardless

When a client is using GoCardless you can create a subscription via

Choose the auto Direct Debit option

The subscription creates a standalone invoice on cash terms

Just that charge will go through GoCardless

Flyerlink will create a cashbook against the invoice when the GoCardless charge is made

If the charge bounces or is refunded or fails, we'll create a refund cashbook against the invoice to show payment is still required

You can also use GoCardless to collect by direct debit any non-subscription invoice with an outstanding balance.

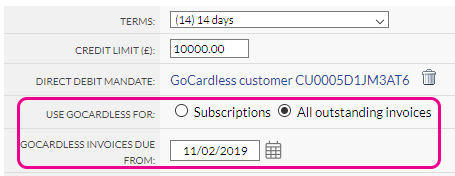

When your customer has given you a direct debit mandate, you'll see an option to take by GoCardless just subscriptions or all outstanding invoices.

Please note: this option is hidden for customers on CASH terms

You'll need a payment term that gives at least 1 extra day notice to customer for how much is being taken.

To take all invoices - choose a date from which to start taking by Direct Debit. Flyerlink defaults to today's date.

If you choose an older date, do beware that Flyerlink will take payment for the outstanding balance due to all invoices due after the date you chose automatically overnight.

So please review your customer's outstanding invoices via and alert the customer that payment for those items will be taken before choosing an older date.

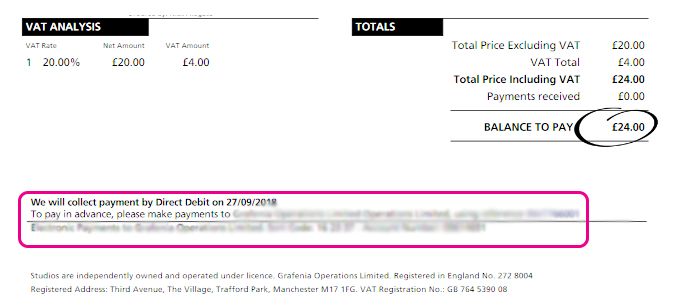

Flyerlink will add a note to any invoice due after this date with an outstanding balance that it will be taken by direct debit. This enables your invoice to act as advanced notice for taking a variable amount by direct debit.

The charge is taken by GoCardless 2 days before the due date - so the payment leaves the customer bank on the due date. If you need to change the length of the due date on invoices you can do this by changing the customers payment terms.

The charge is only for the outstanding remaining balance on an invoice - the charge will deduct any existing payment or credit allocations

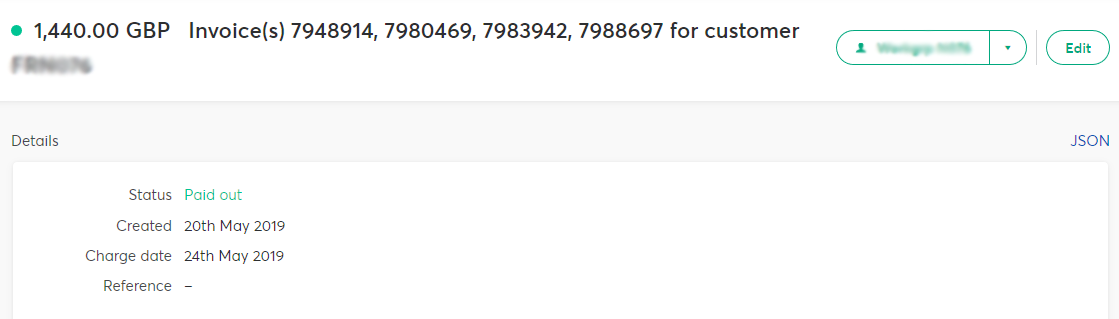

For customer on end of month credit terms they could have multiple invoices due on the same date.

Rather than charge for each invoice, the integration groups outstanding overdue invoices so any invoices due on the the same date would get charged in one

Your charge in GoCardless will reference all the invoices the payment is for

The customer will also be emailed when the charge is placed explaining all the invoices the charge is for and the amount the charge is for.

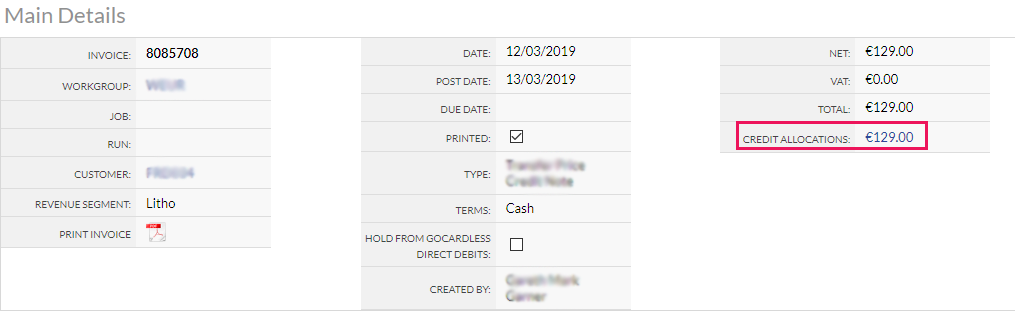

If you have to raise a credit for a customer who's on automatic GoCardless collection, before creating a charge the integration will automatically allocate the credit to invoices that are overdue

That way you can be confident a customer who has payments collected regularly always has a settled account including any credits

To ensure the credit is allocated to the correct invoice, you can allocate it before the next charge is automatically raised.

After a direct debit is initiated, if the payment bounces or the mandate is failed the client will automatically be emailed to let them know the payment failed with a link to pay by card online

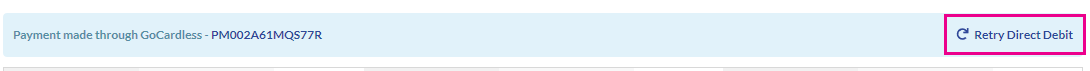

If you have a conversation with the client and they ask you to take by Direct Debit, you can find the invoice in flyerlink and press the "Retry Direct Debit" link

This will queue the invoice up so it will be retried overnight the following night

Direct Debits are cheaper than Credit or Debit Card payments, with GoCardless charges at 1% capped at a max of £2.

However, Direct Debits are easier for customers to dispute or charge back. For partners on credit terms use Direct Debit, for those you don't trust as much use card payments.

How much can I charge by Direct Debit?

GoCardless by default caps payments at £5,000

So any payments over £5,000 cannot be taken through our API

You can contact GoCardless to get this limit raised

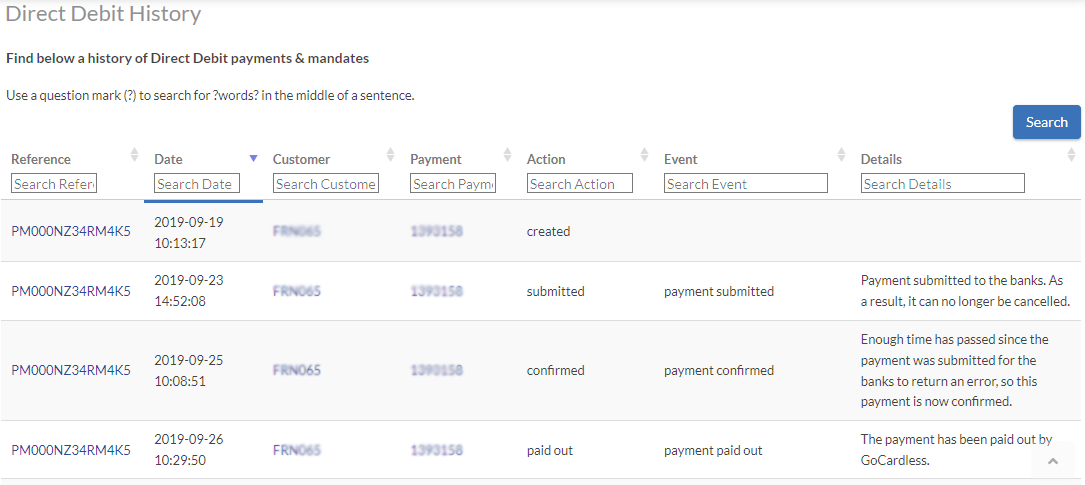

How can I see the progress of Direct Debit payments and mandates?

Head to

Here you can see a log of all the direct debit payments and mandates initiated from Flyerlink

It will show if there have been any errors taking payments and the details of the errors

And also it links to the customers and payments affected by the Direct Debit

With GoCardless the charge takes 2 days to leave the client's account, GoCardless then hold payment 2 more days so you get paid 4 days after the charge.

If the invoice was made with more than 2 days notice we will charge 2 days before the due date - so the payment leaves the client account on the due date - but it will still be held by GoCardless for 2 days.

If the payment bounces or is disputed before it's paid to your account, GoCardless will refund the client.

A reversal payment will also be created in Flyerlink so the invoices affected show as overdue with an outstanding balance.

We will then automatically email the client (copying in the workgroup invoicing email address) asking them to pay online by card and get in contact if there's a payment dispute to remedy

The subscription payment option is decided per subscription - so make sure to set GoCardless for subscriptions if the customer collects Direct Debit for all other invoices.

Jump to contents page of

|

|||||